Long vs. Short in Futures Trading Explained

Date Modified: 3/22/2023

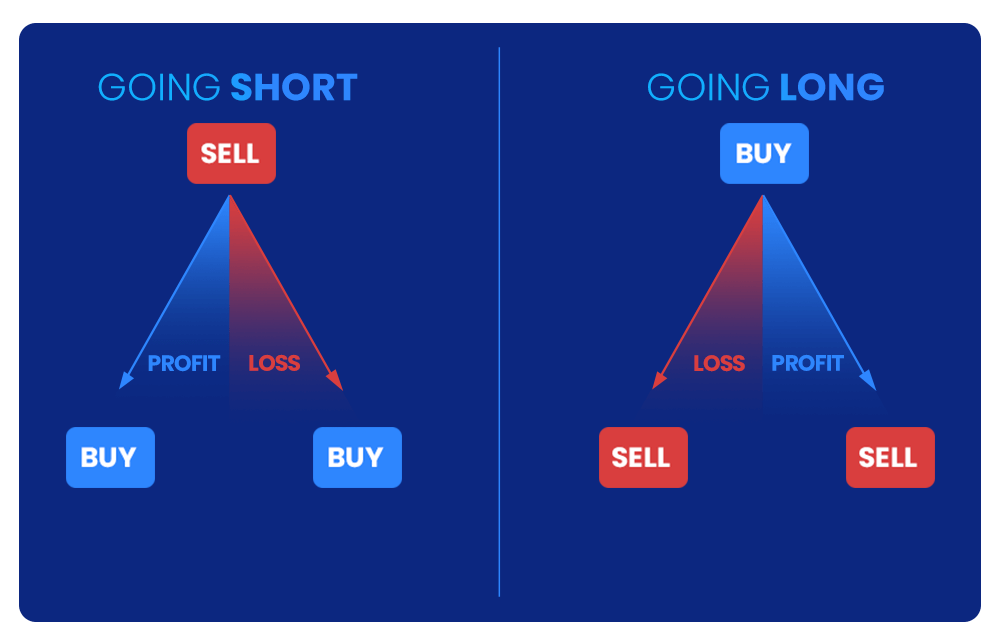

When trading Futures, you may open a position by either buying or selling first. These two acts are called going long and going short whereby the act of buying is called going long and selling is called going short. So what’s the difference between short and long positions, how are they used, and what is short-selling?

Buying vs. Selling

Traders usually go long or open a buy position on certain Futures contracts when they believe that the Future’s price is likely to rise in the future. On the flip side, when traders believe that the price will fall, they are more likely to open a short position, or in other words, they may go short. It is important to note, however, that the Futures market offers access to a myriad of financial instruments, and with that access and flexibility also comes the possibility of volatility. As such, opening a buy position will not necessarily end in gains and vice versa.

What Does It Mean to Short a Futures Contract?

Going short or shorting a Futures contract refers to the act of selling to open a position with the intention of hopefully profiting from market downtrends. Accordingly, if the trader opens a short position, he is speculating on the asset's price to decline. Usually, traders sell short in anticipation of eventually buying the contract at a hopefully lower price in the future.

Selling in Futures vs Short Selling in the Stock Market

Shorting in the Futures market differs from short selling in the stock market in that the former does not have as many restrictions as the latter. For example, shorting in the stock market is usually limited to one day and the price swings may not occur on the same day which means that the position can end up being closed with a loss. In addition, selling in the Futures market allows traders to sell stock Indexes, metals, and other commodities whereby in the stock market the selling is usually confined to individual stock symbols. But the biggest difference between the two is perhaps the fact that while in the stock market, short selling requires borrowing shares from the broker and paying a borrowing rate, in the Futures market it does not.

In the stock market, short sellers borrow shares of stocks or other assets they believe will decrease in value. Investors can then sell these borrowed shares at market prices to buyers. As long as the share price continues to decline, the trader can repurchase the shares at a lower price before returning the borrowed shares. In Futures trading, on the other hand, traders do not need to borrow anything from the broker and they can create a short position at any given time.

What Are the Potential Benefits of Short Positions in the Futures Market?

The obvious possible upside of short positions is that traders would (ideally) be able to buy the shorted Futures contract in the future for a lower price. Another advantage of going short in Futures is that the initial deposit required is the same as it is for going long and going short can allow traders to hedge against other positions.

What Are the Potential Risks of Short Positions in Futures?

Short positions can also have their downsides. For example, while it comes with the potential of gaining profits, it can also come with the risk of unlimited losses due to the fact that the Future’s price can rise to a large extent.

Can I Sell Futures Without Buying?

Yes, you can sell Futures without buying. This is because when selling futures, you do not have to make an initial purchase like when shorting stocks. Nonetheless, in order to possibly profit from your short position in Futures trading, you are required to eventually “flatten” your position by buying an equal number of contracts to offset your position.

Conclusion

Traders have the option to buy or sell in the Futures market depending on their goals. With Plus500, traders have the option to go short or long with a few simple steps. Go to your Plus500 Futures account and click on your desired underlying instrument, then choose whether you want to open a buy or sell position based on your goals.